Inflation outlook and foodservice market update - September

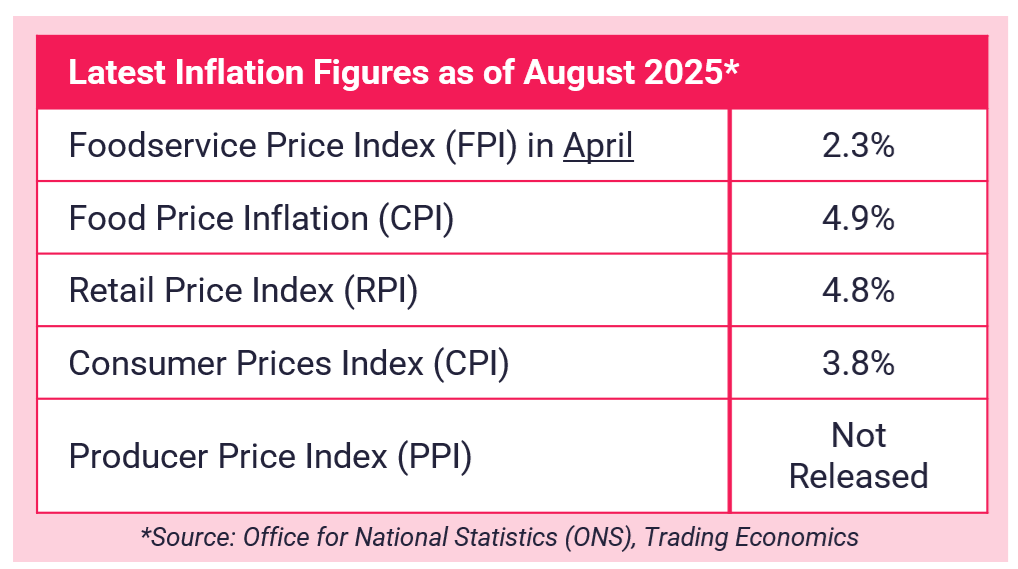

The Consumer Prices Index (CPI) rose by 3.8% in the 12 months to July 2025, up from 3.6% in the 12 months to June 2025. The 12-month inflation rate for food and non-alcoholic beverages was 4.9% in July 2025, up from 4.5% in the 12 months to June. This was the fourth consecutive increase in the annual rate and the highest recorded since February 2024, but it remains well below the peak seen in early 2023. On a monthly basis, food and non-alcoholic beverages prices rose by 0.4% in July 2025, compared with little monthly change a year ago.

The Retail Price Index (RPI) is now 4.8% vs 4.4% last month, up 0.4% while the Producer Price Index (PPI) has not been released.

Market movers:

UK KEY MARKET MOVERS (CPI) The Consumer Prices Index (CPI) is a key measure of inflation in the UK. Movements in CPI give a high level overview of the key categories experiencing inflation. Below is a monthly snapshot of the top food commodity price inflation movements impacting the UK. The data is from Office for National Statistics (ONS). Percentage change over 12 months: FINAL WORD Regency continue to proactively mitigate availability issues and supply risk, putting solutions in place to reduce impact, such as product switches and recipe re-engineering. When analysing the affects that inflation has on your businesses purchasing, it's important to understand that inflation affects not only the price of goods, but also the quality and availability - this is something that our team of procurement experts can assess in detail, to ensure our members are always achieving the best outcomes in all areas. Equally, we fully understand the challenges presented by the increase in Employer National Insurance Contributions and National Living Wage, along with reduction in business rates relief and increased water bills. Our team of experts are working closer than ever with our members to reduce their purchasing costs in attempt to lessen the impact of rising costs in other areas of the business. To find out more about ways in which we can help save your business time and money, get in touch. Sources: Foodbuy, Fairfax Meadow, Birtwistles.